Let’s talk about Kuda vs OPay; which is better today? The best of them is which is better, which has an advantage over the other, and which has similarities.

Both are financial institutions that strive to give individuals seamless financial help. Kuda is a mobile-only bank, whereas OPay is a fintech firm that provides POS machine services to help people with their finances.

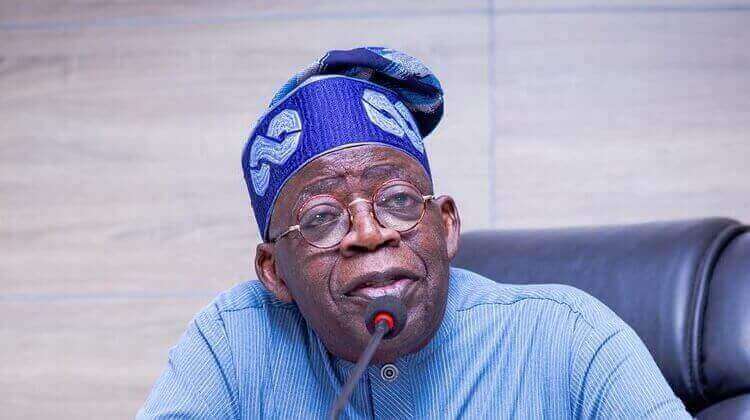

Kuda vs OPay, Companies Profiles and Reviews

Kuda is Nigeria’s first mobile-only bank, approved by the Central Bank of Nigeria and backed by the Nigeria Deposit Insurance Corporation (NDIC). The first mobile-only bank means that all operations and transactions are carried out via the internet. There is no need for a physical bank or institution.

Opera micro, a Chinese firm that also owns Opera news, owns OPay, a banking institution. OPay is presently renowned as a fintech firm that offers one of Nigeria’s best POS services.

Babs Ogundeyi owns Kuda, which she discovered in 2018. OPay, on the other hand, is a Chinese firm that also owns the Opera microbrowser and Opera News.

Kuda Bank and OPay Fintech Company Benefits

Here you will learn about the main benefits of Kuda and OPay.

Kuda Bank’s Benefits

- Kuda Bank provides its customers with a free ATM card, as well as the ability to construct a smart budget to help them manage their spending.

- Without having to solve equations, you can see where your money goes.

- For annual savings, a 15% interest rate is offered.

- For sending money, there are no transaction costs.

- Top-up your phone (buying airtime and data subscription)

- Links for making payments

- Kuda provides 25 free transfers to other banks and charges N10 for subsequent transfers.

- There is no requirement for a physical site.

- You’ll need the kuda app, as well as an internet connection and a debit or credit card.

- Most of all, Kuda is an online bank.

Benefits of OPay

- With OPay, you can work as a POS agent.

- With the OPay smartphone app, you may send and receive money.

- There are no fees for adding money to your wallet.

- Discount on unlimited airtime

- There are no surcharges on utility bills (such as Electricity bills and TV subscriptions)

- Charges of N10 to any Nigerian bank

- On the POS, there are 0.7 transaction fees.

- Offer a free POS to agents who meet the qualifications, as well as a paid POS to those who can’t wait for eligibility.

Kuda and OPay have some similarities.

- The operations of both fintech companies are conducted entirely online.

- Both companies have mobile apps and websites that can be viewed.

- They are concerned with the sending and receiving of money.

- The businesses are well-known.

- Transaction fees of N10 are charged by both financial institutions.

- Kuda and OPay both provide free debit and credit cards that can be managed through the user dashboard.

- To fund their wallet, the user must connect their account to their bank.

So, Kuda vs OPay; which is better? Having read all of the above, the choice is yours, the metaphorical ball is in your court. Thank you for reading; check out further articles of this kind here.